Financial news in the first half of 2025 has been dominated by uncertainty over President Trump’s ongoing tariff negotiations with US global trade partners.

Our friends at Capital Group define a tariff as a tax on goods imported from other countries. In their excellent “Guide to Tariffs” they detail various motivations for implementing tariffs on trade partners. (Source: https://www.capitalgroup.com/advisor/insights/pdfs/ebook-guide-to-tariffs.html). Rising tariff tensions between major economies present a new layer of uncertainty, with potential implications for global supply chains and inflation. While support for or resistance against tariff implementation may coincide with one’s political preferences, the net effect of tariffs is likely to cause a slowdown in economic activity along with higher inflation, as the cost of tariffs tends to be passed on to consumers.

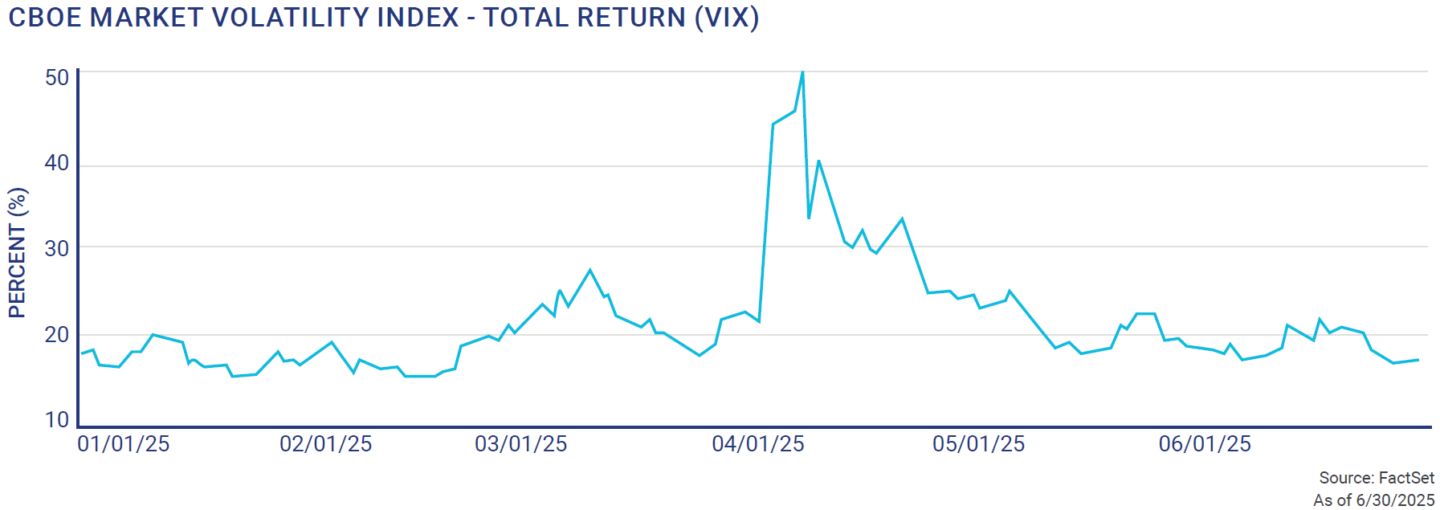

As we reach the midpoint of 2025, capital markets have experienced bouts of high volatility exacerbated by ongoing tariff discussions and threatened retaliatory measures. US equity volatility, as measured by the VIX index in the chart below, has tracked Trump’s multiple tariff announcements, spiking sharply at the beginning of the second quarter as Trump ratcheted up tariff pressure on China.

Since the year-to-date low on April 8, however, the market has responded strongly — and the rally has broadened out somewhat from the mega-cap tech names that led in 2023 and early 2024, though valuations now appear stretched in several areas of the market.

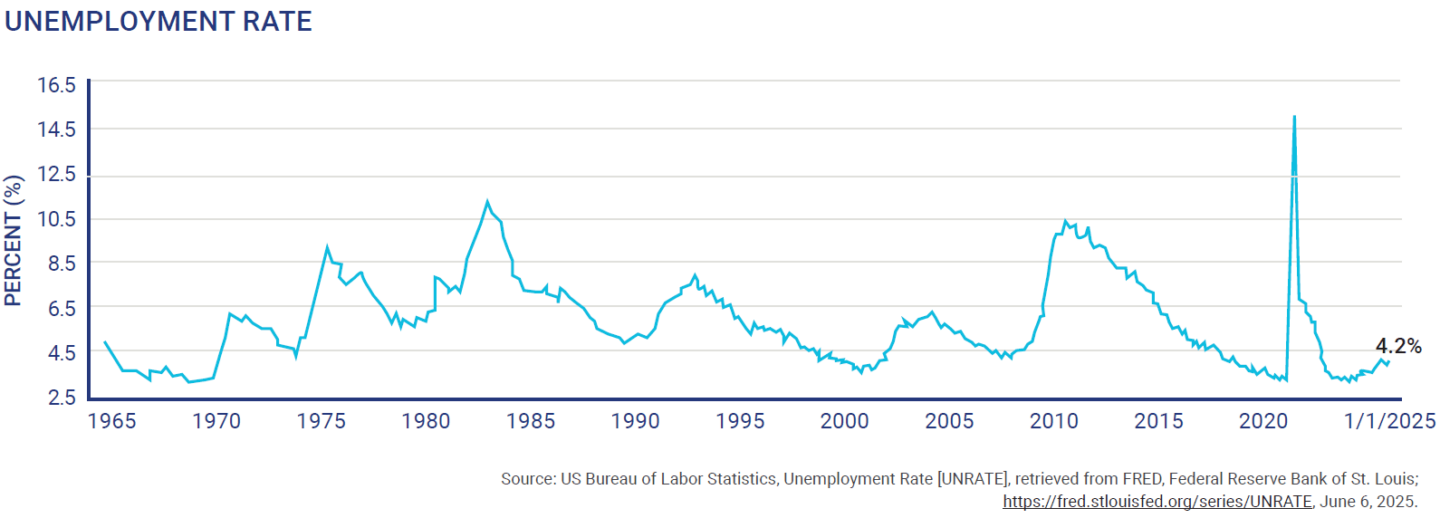

While US equities continue to benefit from strong earnings and robust employment trends, we are increasingly mindful of elevated valuations and lingering macro and geopolitical uncertainty — from domestic political tensions to global conflict risks and policy shifts. As a result, we are maintaining a neutral weighting to stocks, reflecting a balanced view between opportunity and risk.

International equity markets have shown signs of renewed strength, particularly in Europe and select emerging markets, where monetary easing and lower valuations have helped fuel a strong rally. However, while our view has softened somewhat, we are not yet ready to aggressively chase these gains and continue to approach global markets with measured caution. Through the first half of 2025, international developed and emerging markets have returned 19.4% and 15.3%, respectively.

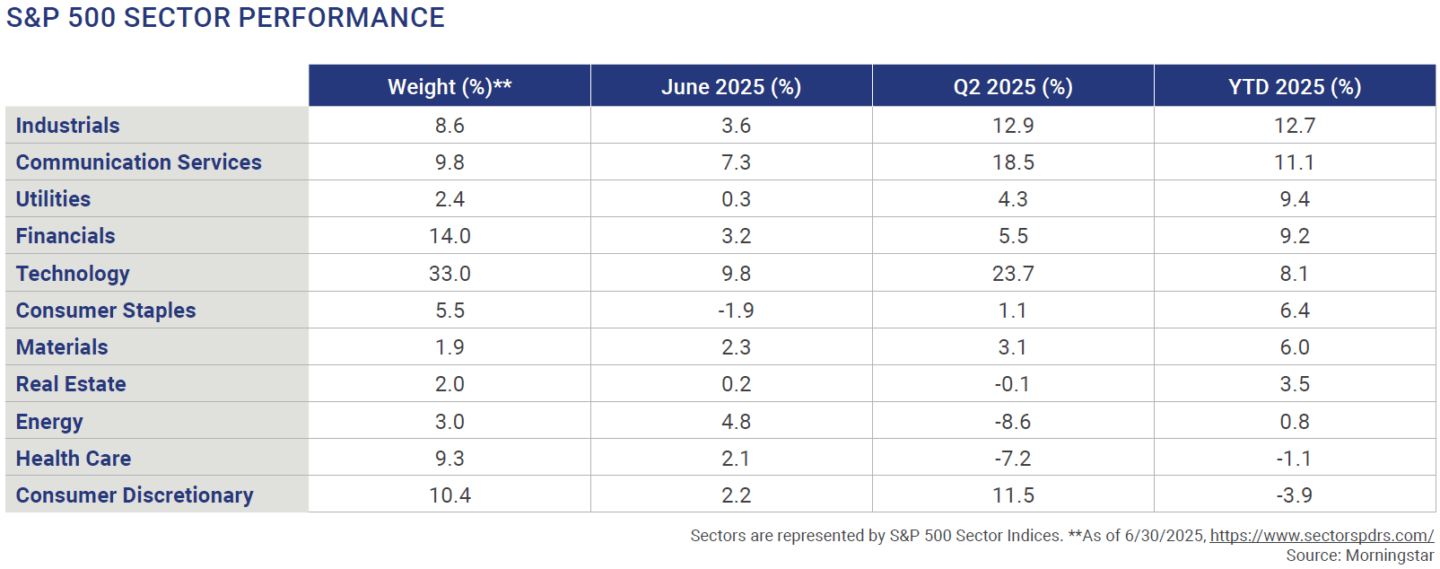

On a sector basis, communication services (where Meta and Alphabet dominate performance) and technology (Apple, Nvidia, and Microsoft hold the top weights) were the top performers in 2024, returning 40.2% and 36.6% respectively. Technology now represents 32.9% of the S&P 500 market cap. As tariff uncertainty continues, the technology sector has cooled off in 2025, returning 8.1% while industrials have turned in the strongest performance, up 12.7%.

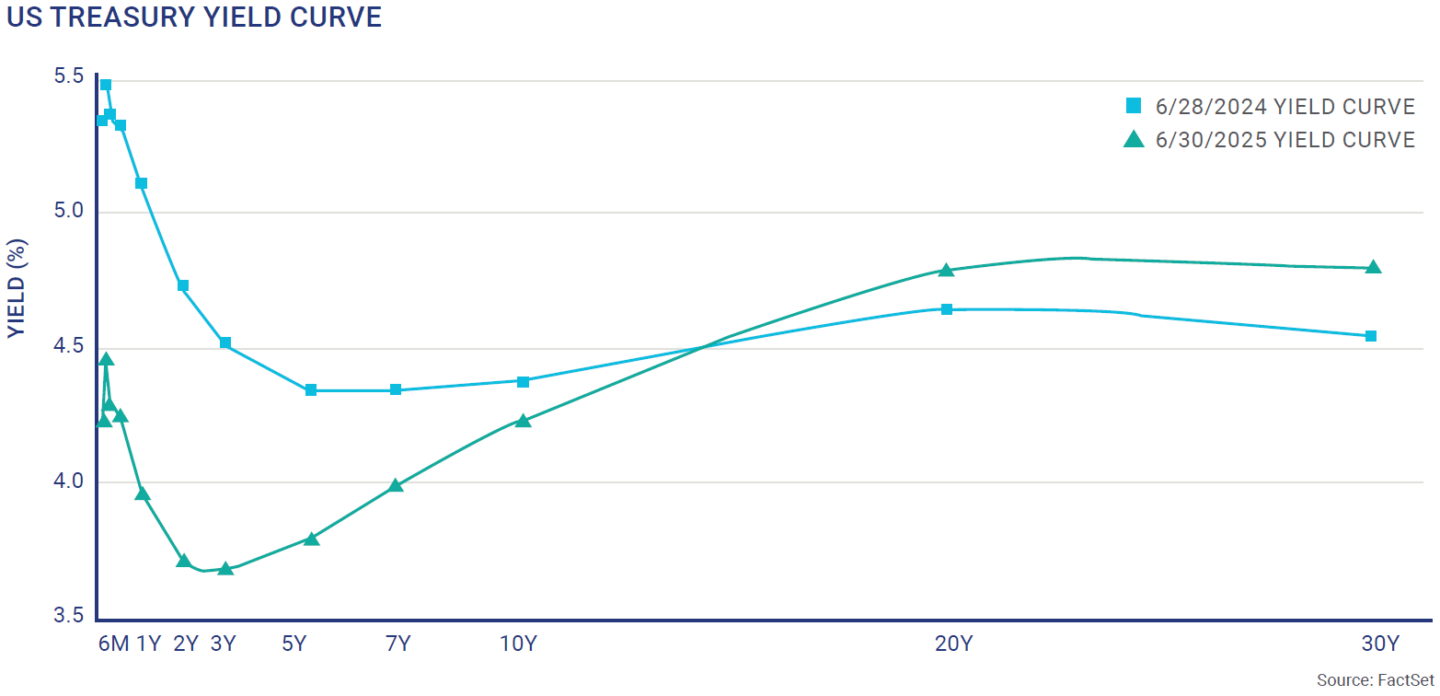

In fixed income, yields remain attractive on the short end of the curve, and we continue to see value there. We remain underweight bonds overall, with a preference for shorter-dated securities. This allows us to capture yield without exposing portfolios to significant duration risk should longer-term rates rise unexpectedly due to renewed inflation pressures or fiscal concerns from government and corporate bond markets.

We continue to believe strongly in the value of diversification beyond traditional stocks and bonds. Our portfolios remain overweight in alternative strategies, where we work with managers who provide uncorrelated sources of return and greater stability during market volatility.

The Fed will also undoubtedly play a key role throughout the back half of 2025. Current market expectations are down to just 2 rate cuts for the remainder of 2025 (Source: https://www.cmegroup.com/markets/interest-rates/cmefedwatch-tool.html). As these expectations continue to shift based on inflation, employment reports and “Fed Speak,” the equity and bond markets will react, creating another potential source of volatility for the remainder of 2025.

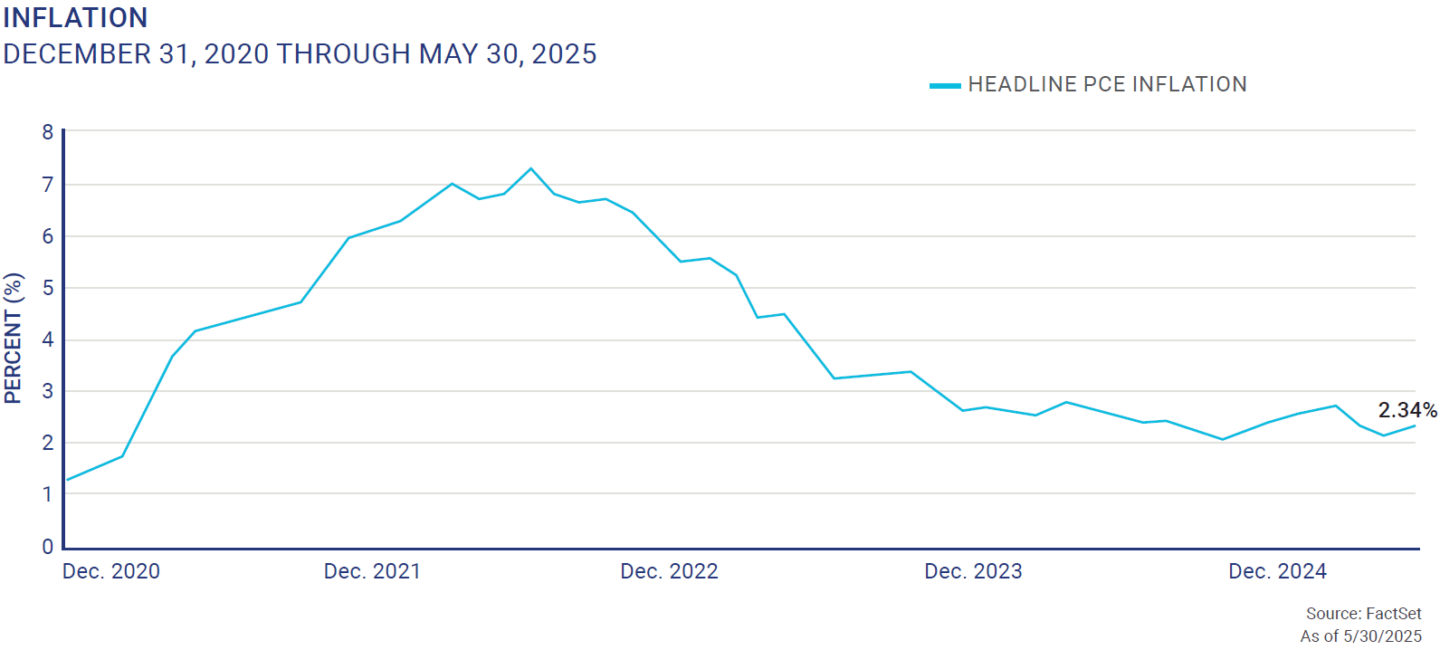

Chairman Powell continues to be steadfast in being data dependent before making changes in policy despite the political pressure he is receiving from the White House. We think the Chairman wants to be confident in the inflation outlook and is waiting to see if the new tariff regime is creating a lag in the inflation statistics. If that is the case, then he and investors will have to once again determine if inflation is “transitory” before shifting policy.

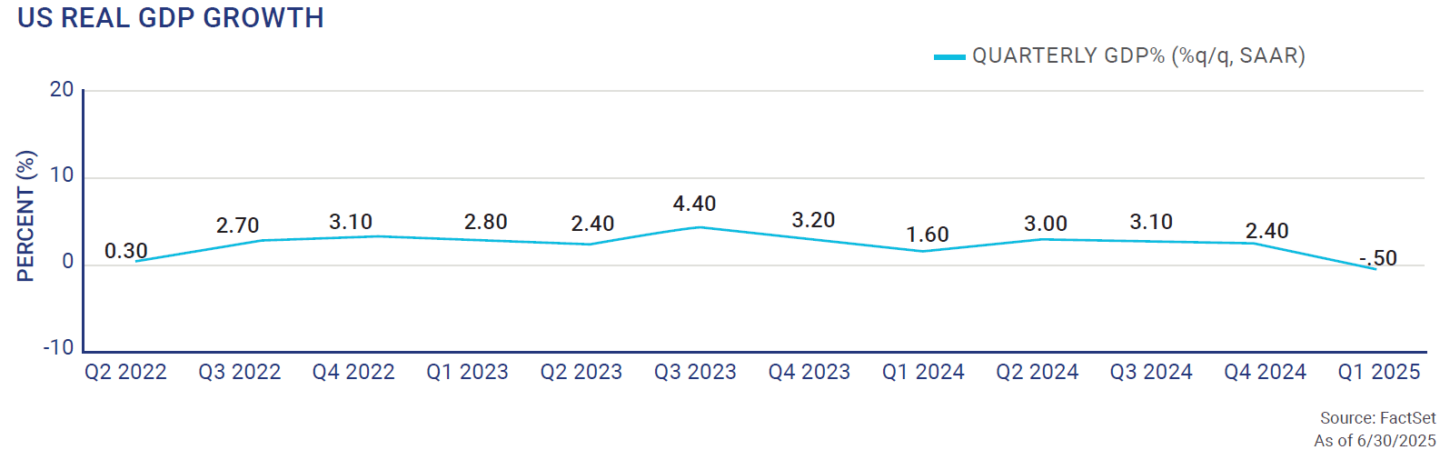

Looking ahead, the second half of 2025 is highly dependent on resolution (or lack thereof) of tariff negotiations. The US economy has been resilient, but GDP has weakened and remains vulnerable. Inflation continues to cool, but tariff induced price increases for goods and services could introduce stagflation and possible recession.

The July 9th tariff deadline appears to be moving out to August 1st, while new tariffs have been announced. The longer we go without some clear-cut resolution, the worse the economic outlook becomes. The US economy and financial markets can deal with tariffs themselves much easier than tariff policy uncertainty.

We encourage clients to stay the course. Remaining disciplined and focused on long-term goals is key to investment success. Market fluctuations are a normal part of the journey, and reacting emotionally to short-term moves often does more harm than good.

Our team remains committed to helping clients navigate this environment with clarity and confidence. We are here to ensure portfolios remain aligned with your goals, and to provide perspective, guidance, and support through whatever the markets may bring.

As always, please don’t hesitate to reach out with any questions or to review your portfolios with us.