Merriam-Webster provides the following definitions for the word “transition”:

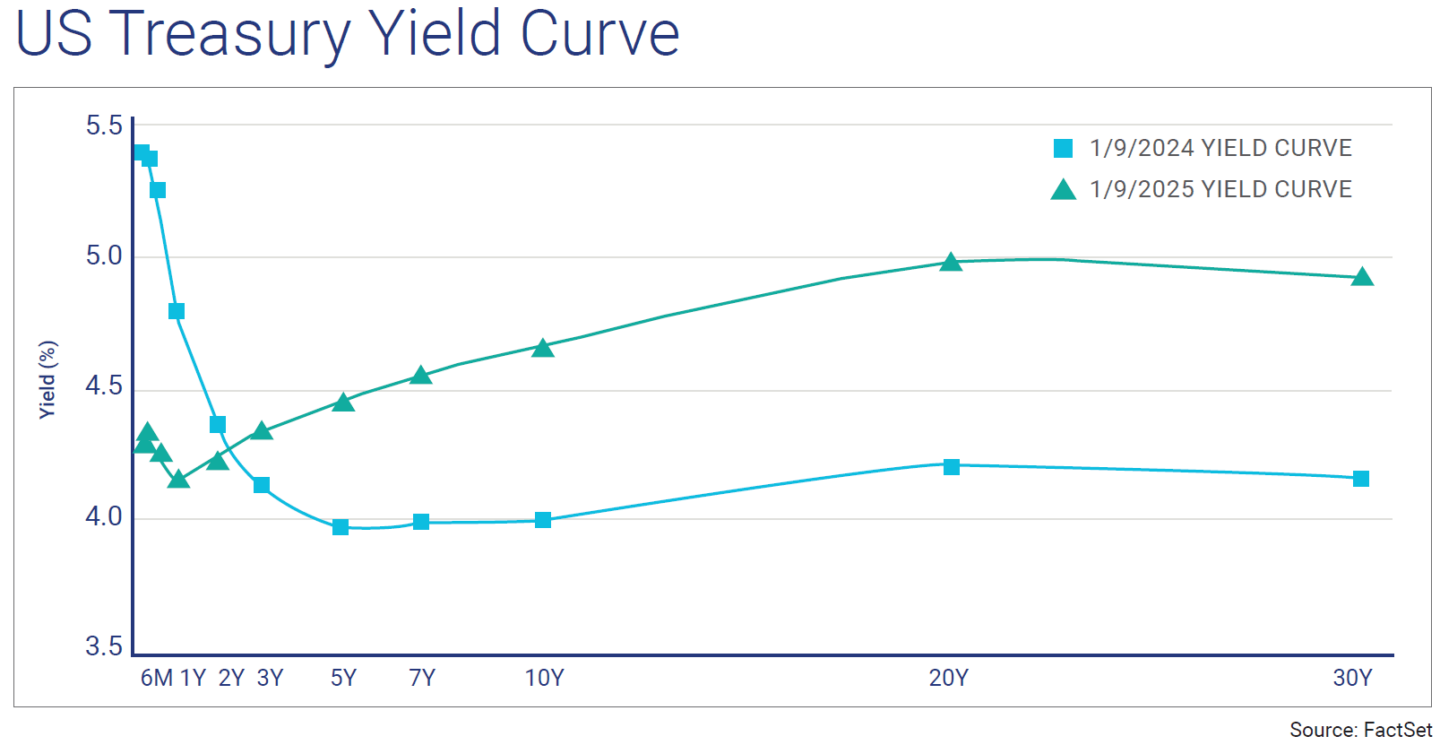

As we enter 2025, investors will face many transitions. The transition from President Biden to President Trump will most likely usher in changes to tax policy and trade negotiations. The Fed will continue to navigate the transition (last year’s “pivot”) to lower short-term interest rates to balance price stability with full employment. Investors will consider a transition from the concentrated US large cap growth market, which has led markets higher, to a broader allocation that includes more small cap, value, and international equities–as well as decide how much duration risk they should incorporate into fixed income portfolios as the bond market transitions from inversion to a positively sloped yield curve.

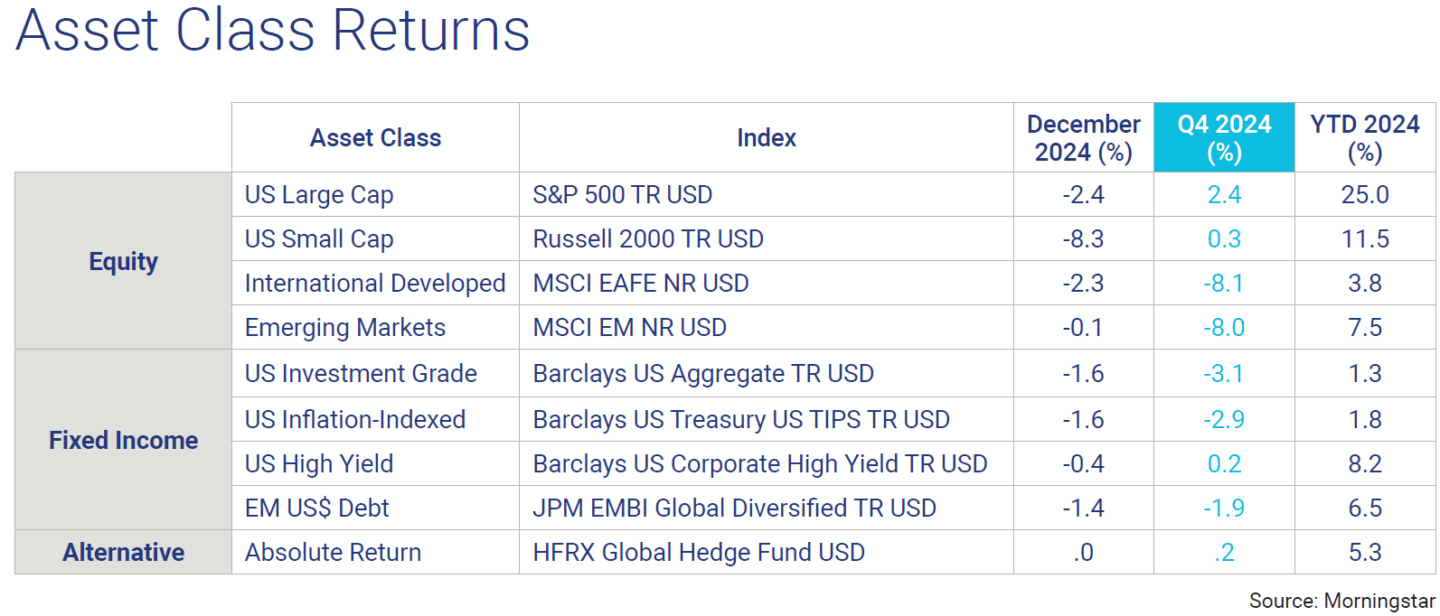

While December 2024 was a weak month for the markets, 2024 overall was a very constructive year for portfolios. The combination of a healthy economy, strong earnings growth, and increased confidence that inflation would be tamed resulted in the second consecutive year of 20%+ gains for US large cap stocks, something that has not happened since 1998. Small cap, international and emerging markets equities all trailed significantly as the chart below shows. Bond prices showed substantial volatility, as the Barclays US Aggregate Bond index gained 8.8% between April 25 and September 16, then declined 3.4% from there to year-end, eventually finishing up just 1.3% for the full year (FactSet calculations: 01/07/2025).

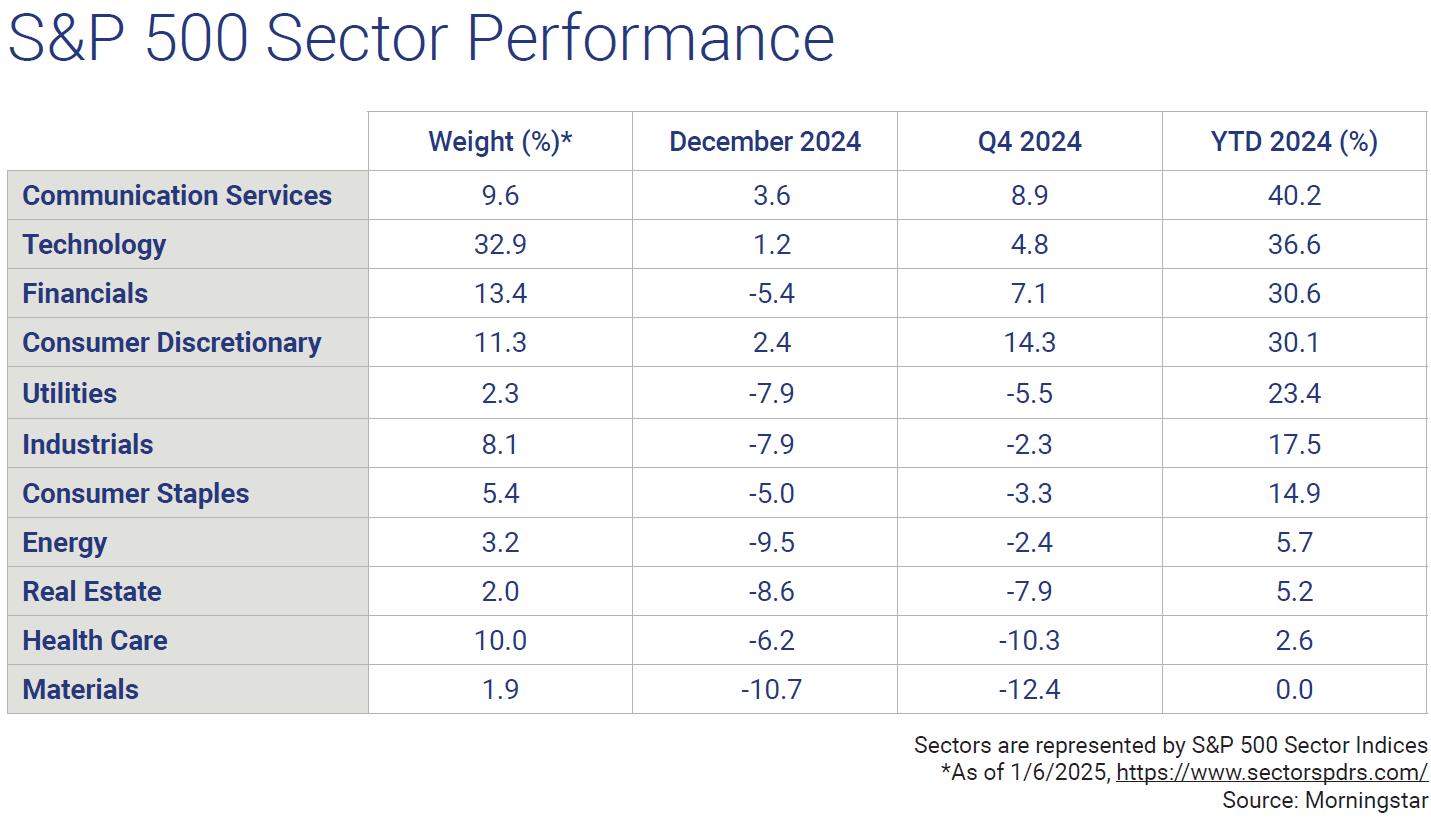

On a sector basis, Communication Services (where Meta and Alphabet dominate performance) and Technology (Apple, Nvidia, and Microsoft hold the top weights) were the top performers in 2024, returning 40.2% and 36.6% respectively. Technology now represents 32.9% of the S&P 500 market cap.

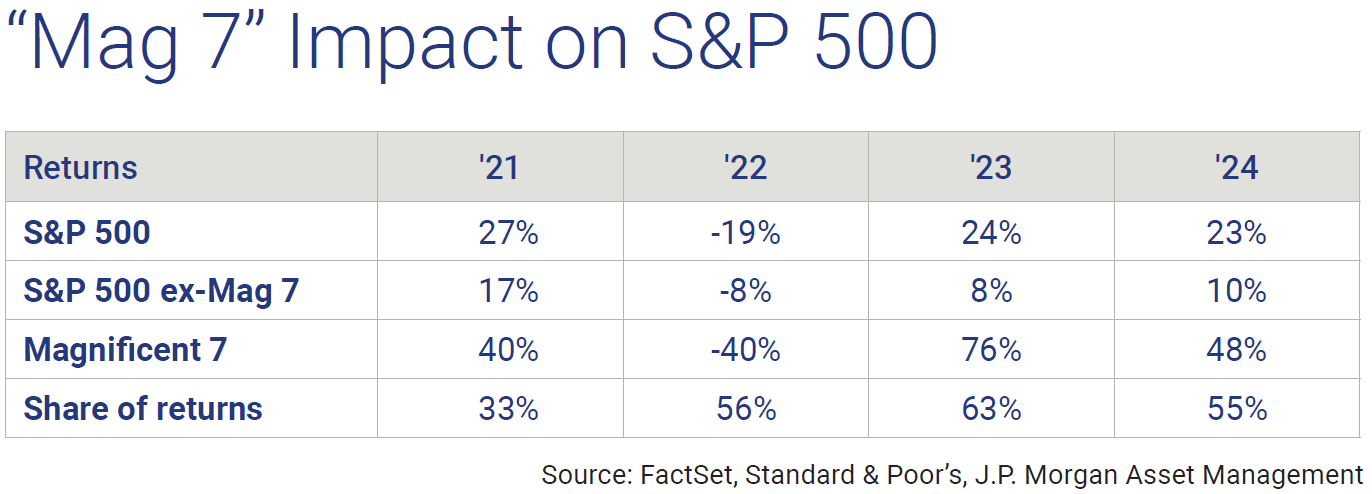

Looking more closely at the concentrated returns that drove S&P 500 performance, the so-called “Mag 7” (Apple, Alphabet, Amazon, Facebook, Microsoft, Tesla, and Nvidia), accounted for an incredible 63% of S&P 500 returns in 2023, and 55% of returns in 2024.

For equities to continue their upward trajectory, we will clearly need to see greater participation beyond the Mag 7.

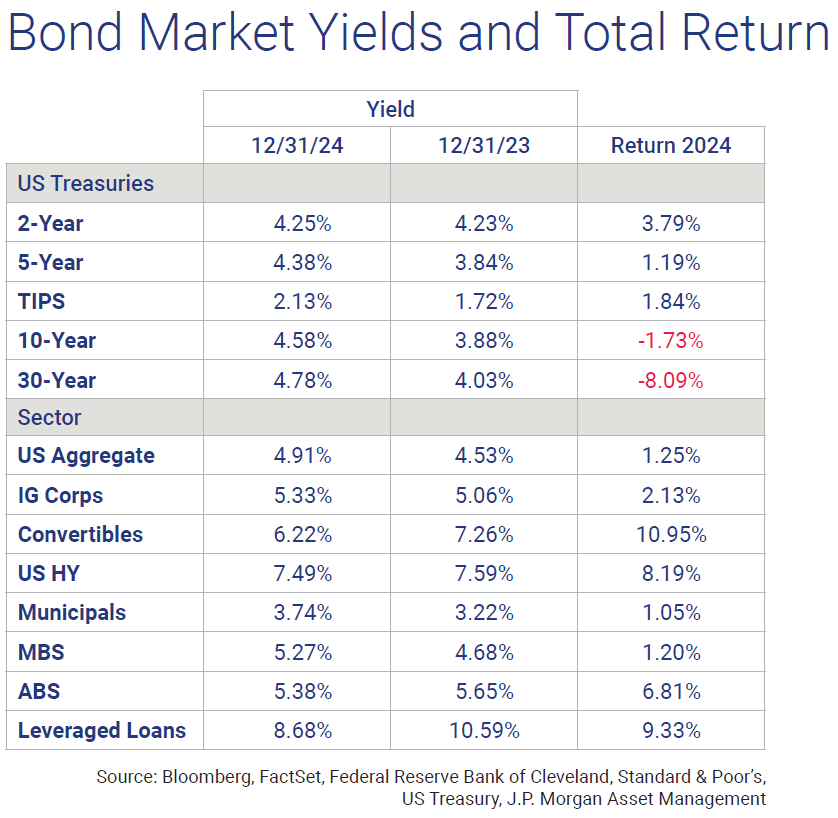

Digging deeper into the bond market, the healthy economy combined with the Federal Reserve’s interest rate reduction policy resulted in high yield and leverage loans being the best performing asset classes in fixed income.

We have dubbed 2025 as the year of transitions. As we consider potential economic, geopolitical, and financial markets-related transitions we believe that both equity and fixed income markets in 2025 will be bolstered by strong corporate balance sheets as well as a resilient consumer.

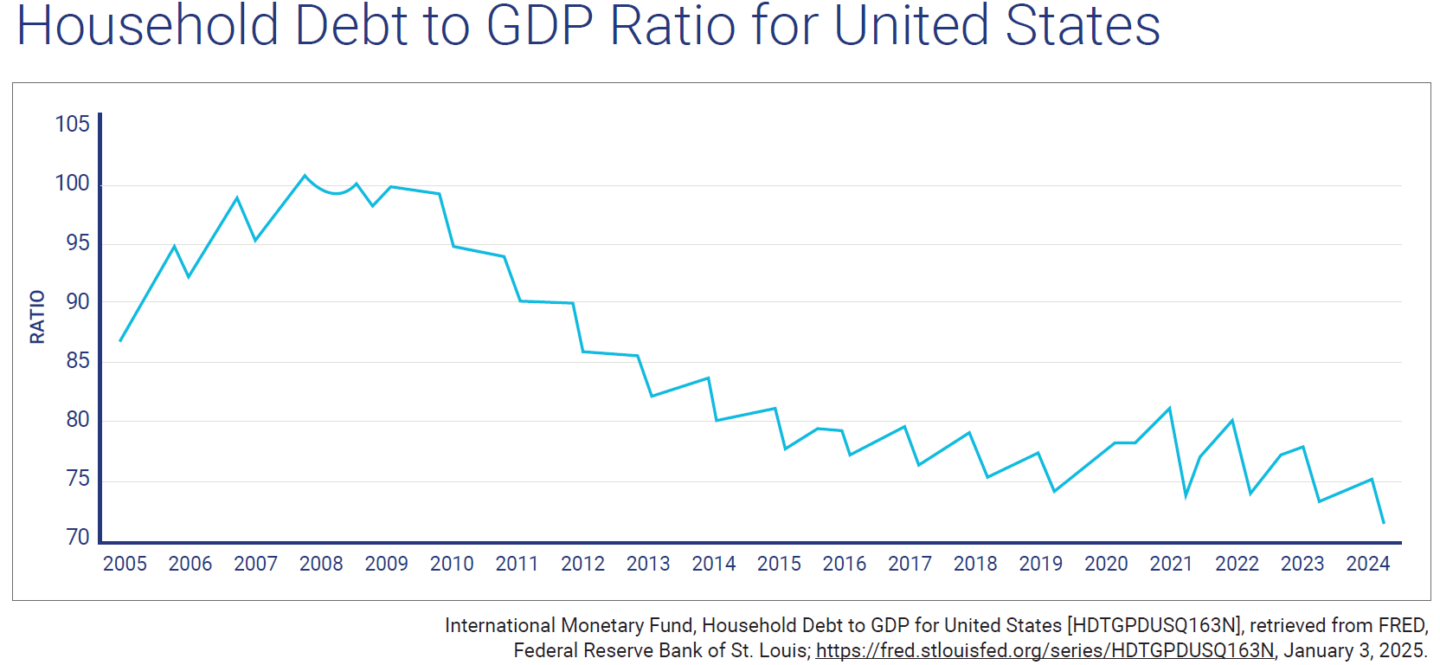

US consumers are very well positioned as they have consistently reduced their debt since hitting a peak during the 2008 financial crisis. As a result, a smaller percentage of disposable income is now allocated to debt service. The US consumer has continued to show a great propensity to spend coming out of the pandemic, and we expect that to continue in 2025.

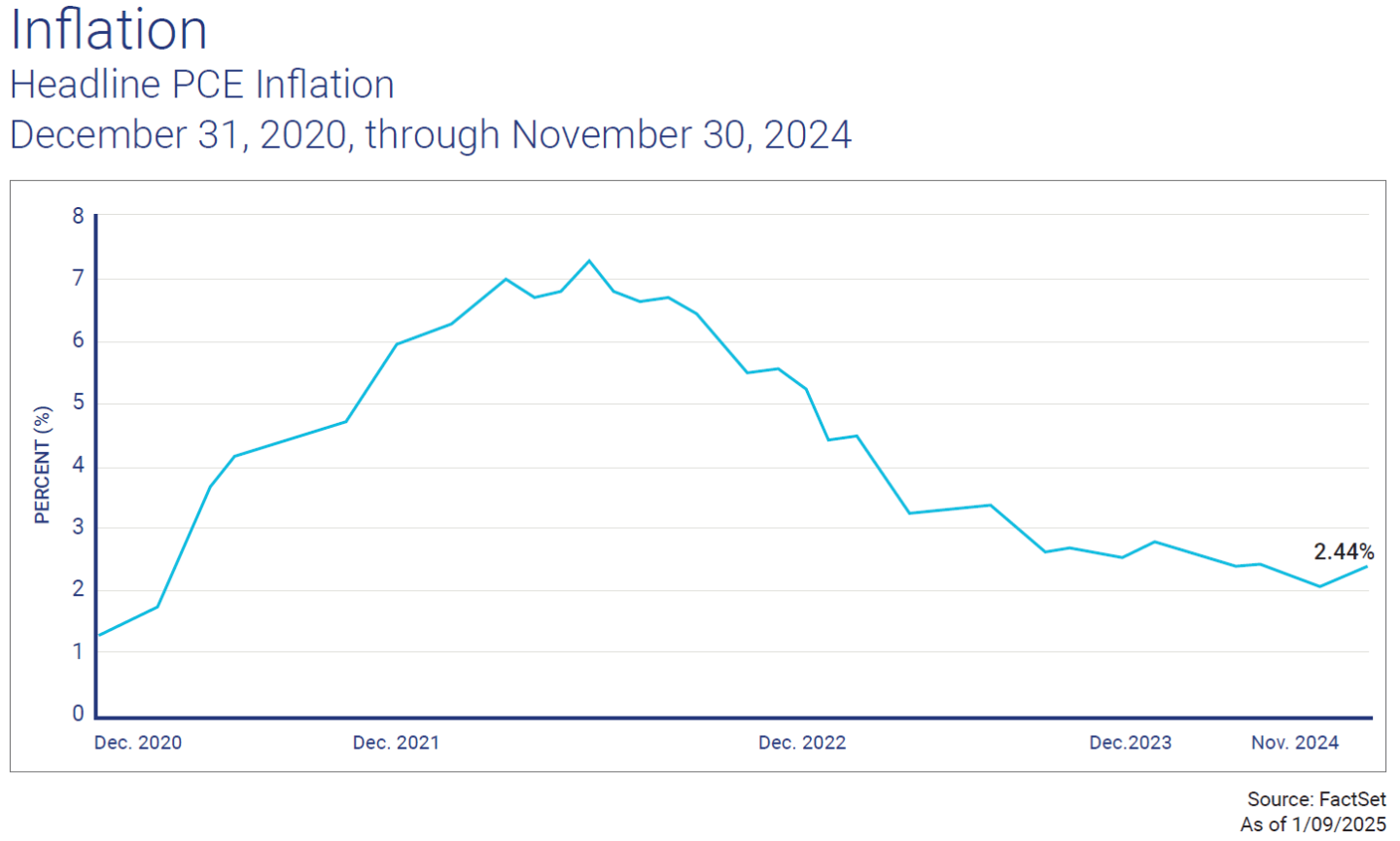

It’s hard to argue with the job that the Fed has done from the outset of the pandemic to the present day. As they continue to unwind the interest rate cuts that propped up the economy early in the pandemic, a data-dependent Fed has balanced the key variables of inflation, growth, and employment quite well. After overheating in the midst of the pandemic, inflation is back to sustainable levels as lingering supply chain issues have finally dissipated.

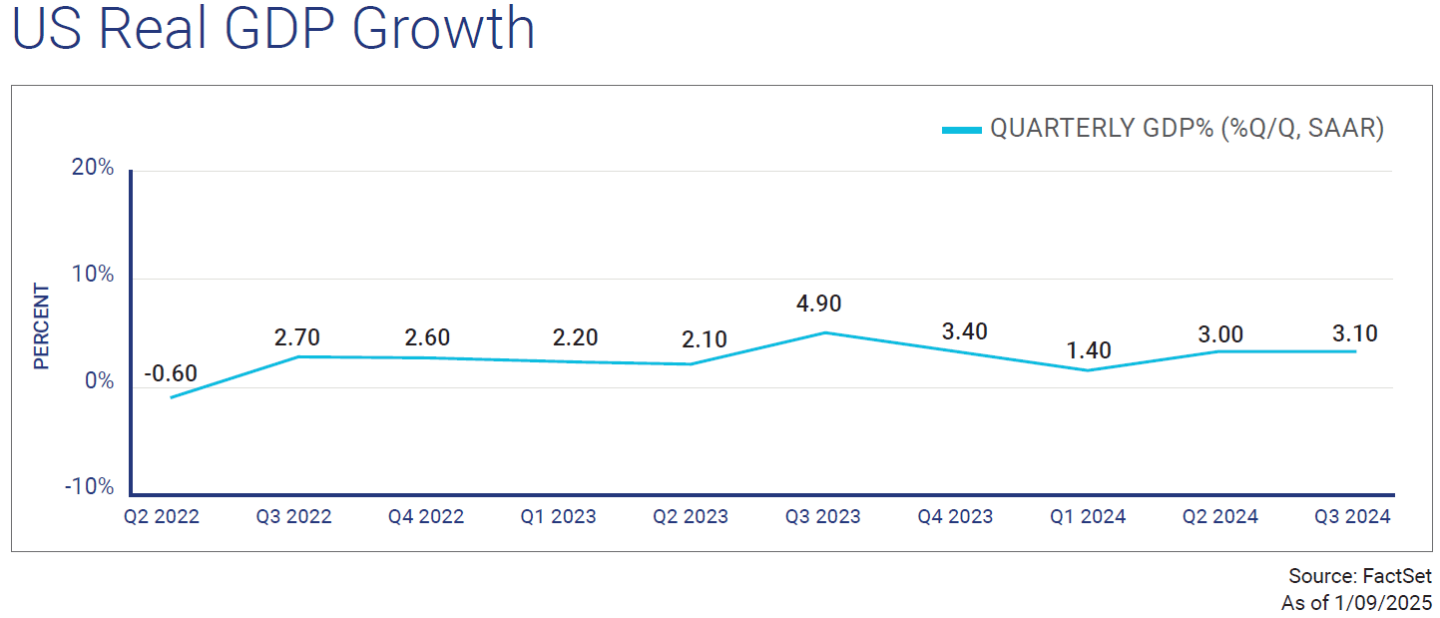

Real GDP is stable at 3.1%.

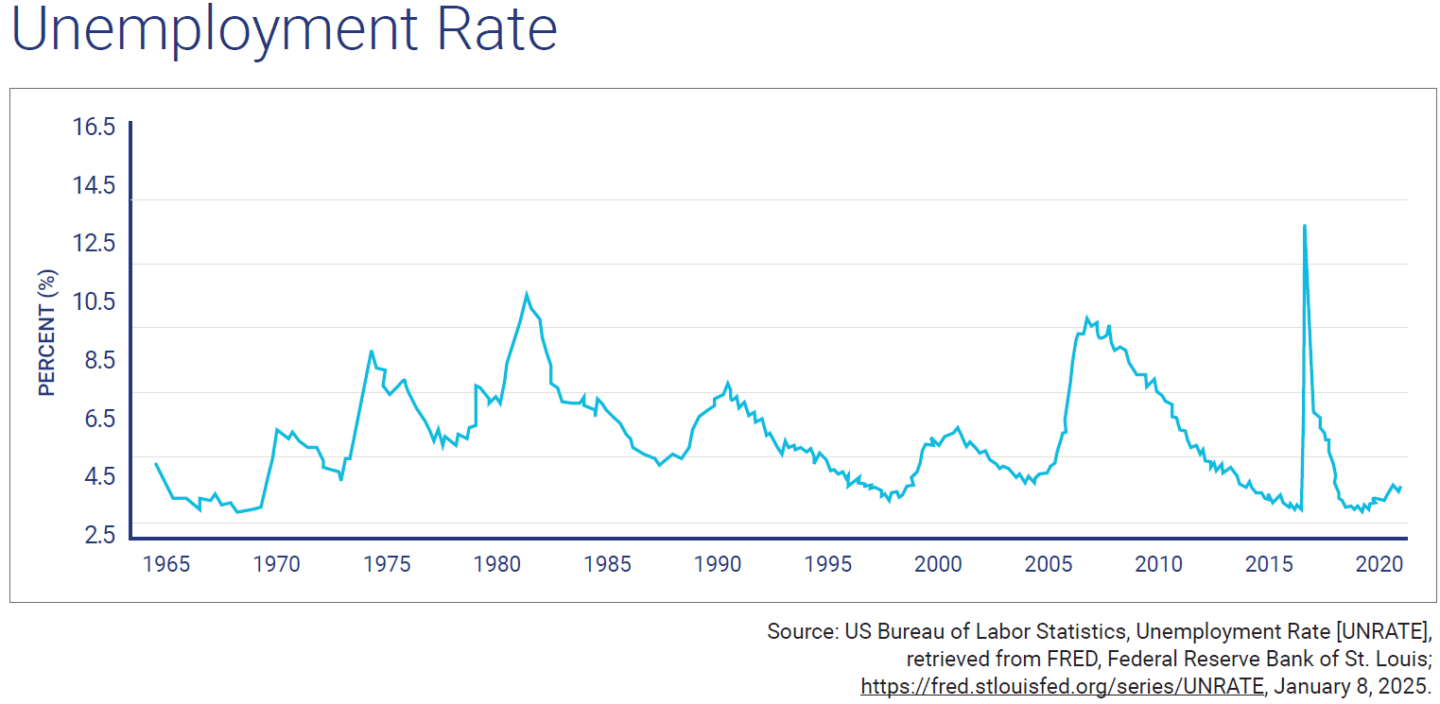

and unemployment at 4%.

However, it was the more volatile components of inflation that drove higher levels, and subsequently lower levels of prices. Future changes in inflation levels will be more dependent on shelter costs, which have not been as volatile as the other components. Overall, inflation (not accounting for new economic policies) should continue to trend down as there will be easier comparisons in the first half of the year. Given the stable job market, normalized wage growth, and limited reason for concern about the volatile components of inflation, it seems there is room for the Federal Reserve to continue interest rate cuts given the level of real rates.

The current employment backdrop is positive, with the spread between job listings and people searching for jobs having narrowed. In other words, the number of people looking for employment relative to the number of openings is in balance.

Given this dynamic, the Federal Reserve should not be overly concerned about higher wages driving an uptick in inflation.

However, this will bear watching all year as the Fed recently reduced their expectations for interest rate cuts from 4 cuts in 2025 to 2 cuts in 2025 (source: FOMC statement and Dot Plot, meeting date 12/18/24). As the year goes on, we see two possible developments that could create upward pressure on rates. First, tariffs. Tariffs might prove to be a one-time price shock with higher prices leading to less economic activity and a potential deceleration in economic growth. Simultaneously, an inflationary environment resulting from tariffs could prevent the Federal Reserve from reducing interest rates, unless, of course, the negative economic impact is so great that concerns of a recession arise.

The second potential issue to watch is government debt and deficit. In 2024, US government spending totaled $6.75 trillion. US government revenue was $4.92 trillion, which resulted in a deficit of $1.83 trillion. Multiple forecasts have the deficit growing to $2 trillion and interest payments on the approximate $34 trillion national debt growing to $1.2 trillion per year. While some would argue that the deficit as a percentage of US GDP (currently 6.4% of US GDP, per https://www.statista.com/statistics/217428/us-budgetbalance-and-forecast-as-a-percentage-of-the-gdp/) is a more important relationship, clearly increased deficit spending is a troubling trend.

We believe the potential for Fed rate cuts due to a tariff-related economic slowdown will be challenged by the inflationary pressure on prices that tariffs present along with the overhang of the government debt burden. As a result, we see a relatively stable yield for longer maturities as the short end of the curve continues to “uninvert”.

Given the economic backdrop we have laid out above, what can investors expect from equity markets in 2025?

While it might be difficult to expect a third consecutive year of 20%+ gains for the S&P 500, the overall backdrop for equities still looks attractive to us, as outlined in detail above. While high valuations are often unsustainable, a solid economic landscape allows strong companies to grow their earnings faster. As of 12/31/24, the forward price/earnings ratio for the S&P 500 stood at 21.5, which is well above the 30-year average of 16.9 (source: JPM Guide to the Markets, 12/31/24). History reminds us that markets can sustain high multiples for long periods of time, and elevated valuations alone are not a reason to try to “time the market” or expect a prolonged downturn. However, these valuations do put us at the risk of short-term pullbacks if data disappoints and this cannot be ignored.

A strong economy also provides the opportunity for market breadth to expand beyond large cap technology stocks as investors start to appreciate the relative growth opportunity in other areas of the market. The Health Care, Industrial and Materials sectors are all expected to grow their year-over-year earnings at rates above that of the overall S&P in 2025 (source: FactSet, “Earnings Insight” January 3, 2025). Additionally, the “Magnificent 7” accounts for almost a quarter of the S&P 500 earnings, and expectations for future growth remains high. While the promise of artificial intelligence continues to keep the tech sector at the heart of economic growth, “the other 493” S&P 500 companies will need to contribute meaningfully if US large cap equities are to continue their market leadership in 2025.

any strategists are pounding the table for international equities to (finally) outperform US equities in 2025, but we would say “not so fast.” While a case can be made for international from a valuation standpoint, we think that is potentially the only reason (lower valuations do not mean prices need to increase). The US economy is still projected to grow much faster than the Eurozone or Japan in 2025, with analyst’s’ consensus estimates of US 2025 GDP coming in at over 2%, and those other economies all in the 0.5%-1.5% range (source: FactSet as of 1/3/25). Also, a wide array of geopolitical concerns and an anticipated stronger dollar could disproportionately negatively impact overseas markets.

As a result, we continue to favor US large cap equities and an overweight to the technology sector. We have modestly added to US small cap stocks, which tend to do well in a low interest rate environment as the economy stabilizes.

In bond portfolios, our allocations to short duration investment-grade bonds, coupled with modest exposure to convertibles, preferred securities, high yield, and floating rate exposure led to substantial outperformance relative to the aggregate bond index returns. As the Fed has eliminated the opportunity to clip 5% coupons in short treasury maturities, we have lengthened the maturities of our bond holdings. The chart below illustrates the dramatic change in the treasury yield curve from early January 2024 to our current curve as of January 9, 2025. It is hard to believe that the 1-year return on the aggregate bond index, which was 11.6% at the end of September 2024, declined to just 1.8% for the 1-year period ending just three months later on December 31, 2024 (source: FactSet, 01/09/2024).

We avoided that volatility and ended up substantially outperforming the aggregate bond index. After the significant rise in longer-dated bond yields, we now expect the 10-year Treasury bond to stabilize near current levels and are positioned accordingly.

Lastly, we continue to invest in liquid alternative strategies, which have served clients very well for an extended period.

The wildcard in our outlook is President Trump’s agenda. Much of the agenda is fundamentally a positive for equities, but not all of it. There are many competing implications between campaign rhetoric and what is ultimately implemented. For example, if tax cuts are made a priority on day one, the market may rally. If tariffs are prioritized, volatility is likely to increase. This should ultimately lead to “buying dips” in the equity market and being satisfied with collecting the income being offered in the way of current higher fixed income yields. With so many transitions in store for 2025 we will, no doubt, have “both hands on the steering wheel” as we actively manage client portfolios.

We appreciate your continued partnership and trust in Webster Private Bank. Should you have any questions or concerns, please do not hesitate to reach out to your trusted relationship manager. Together, we will navigate the current market environment and seek to achieve your long-term financial goals.