Download our e-Treasury Secure Browser

Download the Sterling e-Treasury Token Client

Download our e-Treasury Secure Browser

Download the Sterling e-Treasury Token Client

Due to weather conditions, NY banking centers in Orange, Rockland, Ulster, and Sullivan county will open at 10am today. Online Banking, Mobile Banking, ATM’s, and the Contact Center remain available.

For optimal viewing experience, please use a supported browser such as Chrome or Edge

Download Edge Download Chrome

Published on May 10, 2019 |

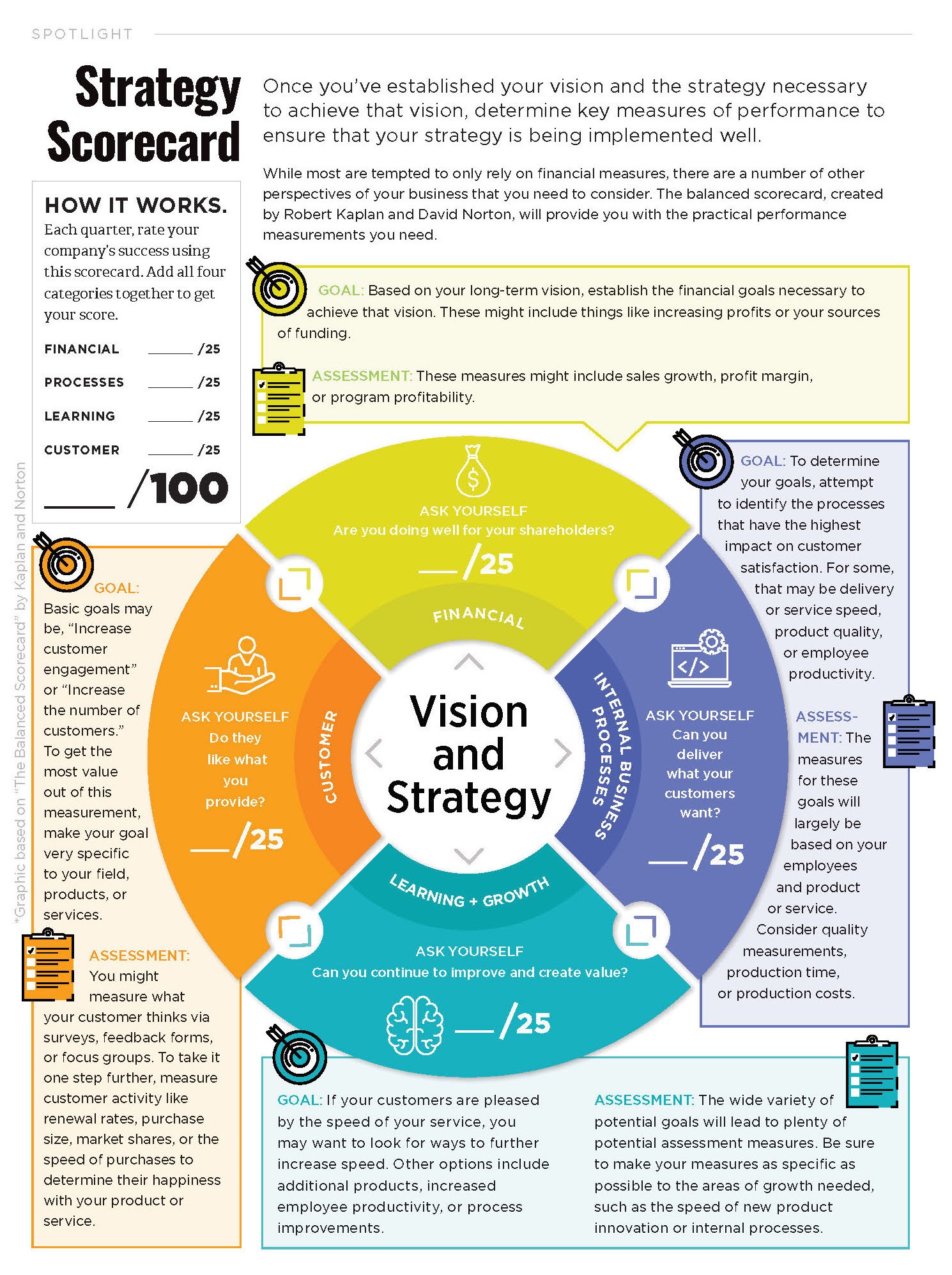

Once you’ve established your vision and the strategy necessary to achieve that vision, determine key measures of performance to ensure that your strategy is being implemented well.

While most are tempted to only rely on financial measures, there are a number of other perspectives of your business that you need to consider. The balanced scorecard, created by Robert Kaplan and David Norton, will provide you with the practical performance measurements you need.

Goal: Based on your long-term vision, establish the financial goals necessary to achieve that vision. These might include things like increasing profits or your sources of funding.

Assessment: These measures might include sales growth, profit margin, or program profitability.

Ask yourself: Are you doing well for your shareholders?

Goal: To determine your goals, attempt to identify the processes that have the highest impact on customer satisfaction. For some, that may be delivery or service speed, product quality, or employee productivity.

Assessment: The measures for these goals will largely be based on your employees and product or service. Consider quality measurements, production time, or production costs.

Ask yourself: Can you deliver what your customers want?

Goal:If your customers are pleased by the speed of your service, you may want to look for ways to further increase speed. Other options include additional products, increased employee productivity, or process improvements.

Assessment: The wide variety of potential goals will lead to plenty of potential assessment measures. Be sure to make your measures as specific as possible to the areas of growth needed, such as the speed of new product innovation or internal processes.

Ask yourself: Can you continue to improve and create value?

Goal: Basic goals may be, “Increase customer engagement” or “Increase the number of customers.” To get the most value out of this measurement, make your goal very specific to your field, products, or services.

Assessment: You might measure what your customer thinks via surveys, feedback forms, or focus groups. To take it one step further, measure customer activity like renewal rates, purchase size, market shares, or the speed of purchases to determine their happiness with your product or service.

Ask yourself: Do they like what you provide?

Webster Bank, N.A.

Webster, Webster Bank, the Webster Bank logo and the W symbol

are trademarks of Webster Financial Corporation and

registered in the U.S. Patent and Trademark Office.

© 2025 Webster Financial Corporation. All rights reserved.